2024 Schedule C Deductions List

-

admin

- 0

2024 Schedule C Deductions List – If you’re a business owner, don’t overlook some of these easy small business tax deductions that could help improve your bottom line. . To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are .

2024 Schedule C Deductions List

Source : www.dochub.comWhat do the Expense entries on the Schedule C mean? – Support

Source : support.taxslayer.comHow To Claim Mileage on Taxes in Five Easy Steps

Source : www.driversnote.comThe Ultimate List of 34 Tax Deductions for Self Employed Business

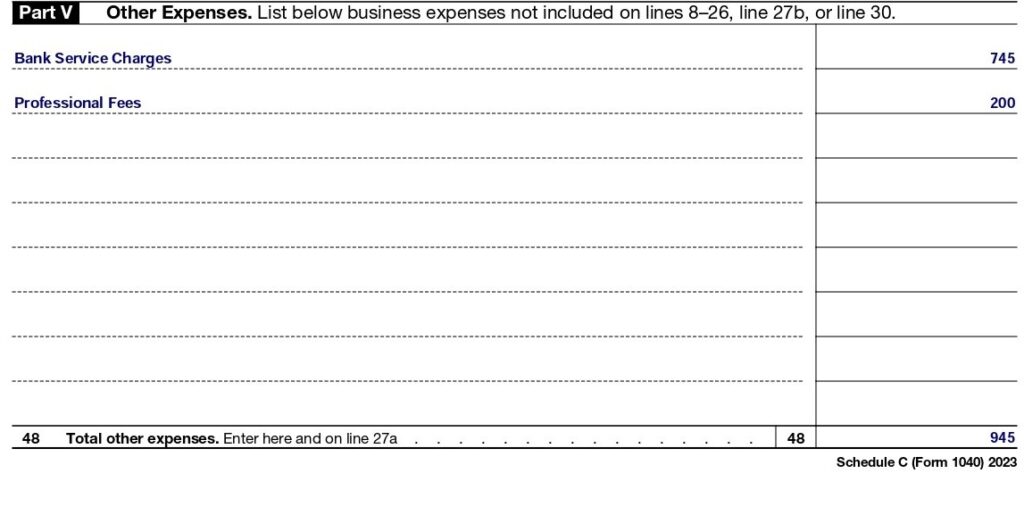

Source : gusto.comHow To Fill Out Schedule C in 2024 (With Example)

Source : fitsmallbusiness.comWhat Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.comFree Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

Source : turbotax.intuit.comSchedule C (Form 1040) 2023 Instructions

Source : lili.coWhat do the Expense entries on the Schedule C mean? – Support

Source : support.taxslayer.comSchedule C (Form 1040) 2023 Instructions

Source : lili.co2024 Schedule C Deductions List Schedule c expenses worksheet: Fill out & sign online | DocHub: Having to report your own business income and expenses adds another layer of complication you are able to take an adjustment for ½ of the tax on Schedule 1. If you are self employed and . You should select a product that also can help you find all the deductions you including Schedule SE for self-employment taxes and Schedule C to report business profit or loss from a .

]]>